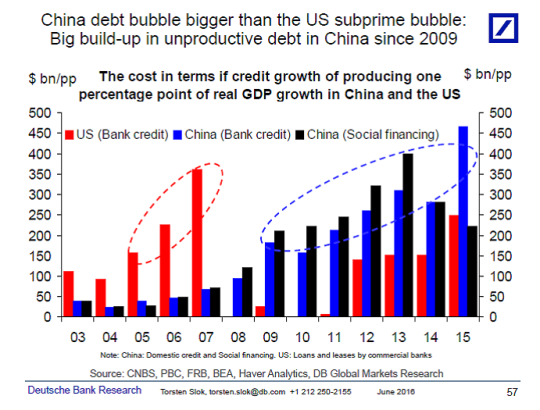

In Shanghai, economist Andy Xie argues that half the Chinese debt is being propped up by real estate prices. Look at the table which compares the Chinese debt bubble to the US sub-prime mortgage bubble. Xie is skeptical that the Chinese Communist Party could intervene successfully, and advocates “hands off the market”. But what does that mean? Is his solution more market fundamentalism or something else? It’s not made clear.